The bitcoin miner turned AI infrastructure play received three price target raises following yesterday’s news, including from Bernstein, which lifted to $125.

Nov 4, 2025, 2:12 p.m.

Wall Street continues to try and stay ahead of the hot-handed IREN (IREN) after yesterday’s $9.7 billion agreement with Microsoft (MSFT) to supply 200 megawatts (MW) of AI data center capacity.

The company’s biggest sell-side fan is Cantor Fitzgerald’s Brett Knoblauch. Bullish on the stock this past summer when it was trading for $10 and continually hiking his price target since, Knoblauch yesterday raised again, this time to $142 from $100. That implies more than a 100% upside from yesterday’s close of $67.75.

Bernstein’s Gautam Chhugani, meanwhile, said the deal with MSFT cements IREN’s position as one of the few infrastructure players owning its own power assets. He hiked his IREN price target to $125 from $75 and reiterated its outperform rating.

The pact could generate $2 billion in annual recurring AI cloud revenue for IREN by 2027, on top of roughly $500 million from existing operations, Chhugani said.

Unlike competitors such as CoreWeave (CRWV) and Nebius (NBIS), IREN’s 2.9 gigawatt (GW) portfolio allows it to expand in line with demand without relying on co-location partners, a structure which will boost profitability, Chhugani continued.

Chhugani now forecasts $2.5 billion in AI cloud revenue by 2027, up from $1.1 billion previously, and values IREN’s Sweetwater site at $5 million per megawatt, based on recent M&A multiples.

Further, the Microsoft deal taps only about 10% of IREN’s total power capacity across British Columbia and Texas, leaving scope to scale further with Microsoft or other hyperscalers.

Roth Capital has also lifted its price target to $94 from $82.

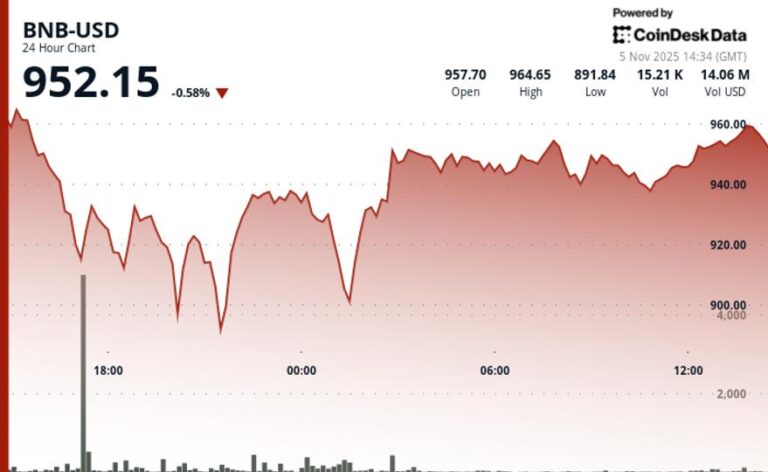

Shares are lower by nearly 5% early Tuesday alongside a general swoon in markets, with Nasdaq futures down 1.5% and bitcoin threatening to tumble below $100,000 level.

Read more: IREN Soars 30% After Inking $9.7B AI Cloud Deal With Tech Giant Microsoft

AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Inside Zcash: Encrypted Money at Planetary Scale

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

Bitcoin Mining Profitability Slumps as Hashprice Falls to Multi-Month Low

Hashprice drops to $43.1 PH/s as bitcoin’s price correction, low fees and record hash rate squeeze miners’ margins.

What to know:

- Bitcoin’s hashprice, the expected daily value of 1 TH/s of mining power, has fallen to its lowest level since April amid a 20% BTC price decline and subdued transaction fees.

- Network hash rate remains above 1.1 ZH/s, pushing mining difficulty to an all-time high of 156T and prompting miners to diversify into AI and HPC data centers for steadier revenue.