Fully satiated shorts were likely booking some profits, but there was a bit of bullish news on the tape as well.

Nov 7, 2025, 8:18 p.m.

A very rough week in crypto markets appears on track to conclude on a slightly positive tone.

About an hour ahead of the close of U.S. stock market trade Friday, the price of bitcoin BTC$103,331.64 has managed to climb back above $103,000 — up about 2% over the past 24 hours — after falling back to the $99,000 area earlier in the session.

It’s some solace for the bulls after bitcoin plunged from above $110,000 at one point Sunday to below $99,000 about 48 hours later.

The bounces in some altcoins were even larger on Friday, with ether ETH$3,445.06, XRP$2.3575 and solana SOL$163.90 ahead 4%-5%, and DOGE$0.1804 and ADA$0.5822, up 12% and 9%, respectively.

For now, the moves higher have all the markings of a modest short-covering rally following dramatic plunges across the sector for most of the week.

Looking closely, though, the bulls will find some green shoots in the latest economic data. Normally, not a massively-followed report, but amid the government shutdown — and lack of official statistics — the University of Michigan Consumer Sentiment Survey released Friday morning took on a bit more import.

Down to 50.3 in November from 53.6 a month earlier, the gauge slumped to levels seen during the Covid panic, the Global Financial Crisis, and the 1990 and 1981 recessions.

At the same time, inflation expectations over the coming 5-10 year period eased a bit but remained perky at 3.6%.

“Consumers perceive pressure on their personal finances from multiple directions,” said survey director Joanne Hsu. “Consumers also anticipate that labor markets will continue to weaken in the future and expect to be personally affected.”

The news suggest the U.S. Federal Reserve — which sent markets tumbling with its surprise hawkish tilt last week — might have to re-consider what appeared to be growing momentum within the central bank not to cut rates again at its final meeting of the year in December.

Congress also reads the papers and the sharp unexpected slump in consumer sentiment will surely not go un-noticed on Capital Hill, possibly pushing officials on both sides of the aisle towards a deal to re-open the government.

Read more: The Fed’s Turning Hawkish as This U.S. Employment Indicator Flashes Red

More For You

Inside Zcash: Encrypted Money at Planetary Scale

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

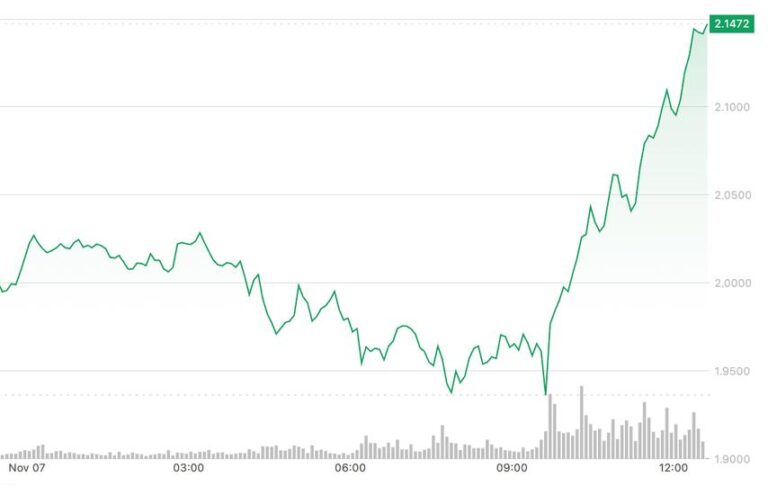

SUI Surges 7% to Break Key Resistance as Broader Market Slips

Low trading volume suggests ‘targeted accumulation’ by whales or institutional players as SUI defies the CD5 index.

What to know:

- SUI gained 7.33% to close at $2.08, significantly outperforming the broader crypto market.

- The rally happened on below-average volume, suggesting that the buying was likely driven by a small number of large traders.

- The token broke through the psychological $2.00 resistance level while most major tokens traded sideways or declined.