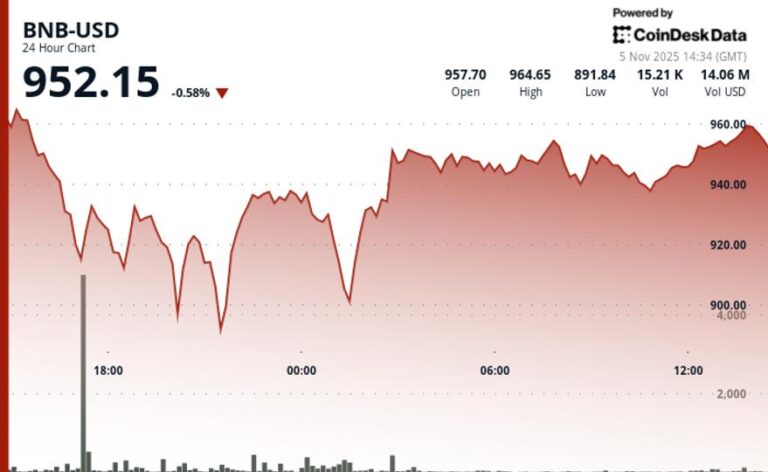

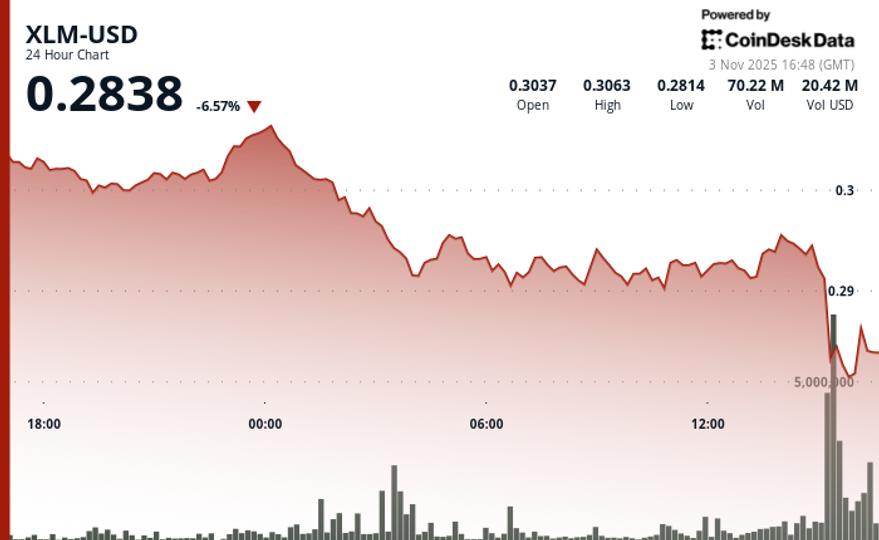

XLM steadies after a sharp 5.5% sell-off, with traders watching the $0.277 level as the critical line between recovery and renewed downside pressure.

Updated Nov 3, 2025, 4:59 p.m. Published Nov 3, 2025, 4:59 p.m.

Stellar (XLM) bounced to $0.285 on Tuesday following a sell-off, with trading volumes running 11.18% above the 30-day average as smart contract activity on the network surged 700%. The rebound marked a clear break from recent consolidation, signaling renewed participation from selective institutional flows.

Despite the rebound, XLM underperformed the broader crypto market (CD5) by 2.10%, reflecting network-specific headwinds even as sector sentiment improved. Traders highlighted Stellar’s $5.4 billion real-world asset tokenization milestone as evidence of growing network utility, though the muted relative strength hinted at cautious rather than exuberant buying.

A brief capitulation between 15:27 and 15:31 UTC saw XLM plunge 5.5% from $0.293 to $0.277, with volume spiking to 12.8 million shares per minute. Support held firm at $0.277, sparking a sharp rebound toward $0.285 as buyers stepped in aggressively following the washout.

Technically, Stellar faces resistance at $0.3014 after a failed hold of $0.2900 support, with current consolidation near $0.281 suggesting balance between bulls and bears. The 887% volume surge during the breakdown underscores lingering volatility even as fundamental momentum builds.

Key Technical Levels Signal Mixed Momentum for XLM

Support & Resistance

- Support: Critical support established at $0.277 following extreme washout.

- Resistance: Strong resistance confirmed at $0.3014 after breakdown from $0.2900 support.

- Range: Current consolidation between $0.281 – $0.285.

Volume Analysis

- 24-hour volume is 11.18% above the 30-day average, confirming directional conviction.

- Breakdown phase: Extraordinary spike to 259.3M shares (+887% vs. SMA).

- Stabilization: Volume normalized below 4M shares, indicating reduced volatility.

Chart Patterns

- Decisive break below ascending trendline support during capitulation.

- 24-hour range: $0.0287 (9.4%) from $0.3038 high to $0.2817 low.

- Stabilization: Price steadying after rebound attempts from $0.277 low.

Targets & Risk/Reward

- Immediate resistance: $0.2900 (former support).

- Upside target: $0.3014, contingent on sustained momentum.

- Downside risk: Retest of $0.277 support if consolidation fails.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Inside Zcash: Encrypted Money at Planetary Scale

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

Bitcoin Nears Lowest Since June as U.S. Government Shutdown Hits Joint Longest

The bitcoin price is approaching $103,000 as the federal shutdown ties the 2018–2019 record while dollar the strengthens and tech market futures decline.

What to know:

- Bitcoin is approaching its lowest price since end-June.

- The U.S. Dollar Index (DXY) has risen above 100 for the first time since Aug. 1, a level that typically puts pressure on risk assets such as BTC and tech stocks.

- The U.S. government shutdown has entered its 35th day, matching the record from 2018–2019, with Polymarket suggesting it may extend beyond mid-November.