Upsized 2 million-share SATA issuance priced at $80 includes a 12% dividend and potential bitcoin allocation.

Updated Nov 6, 2025, 1:48 p.m. Published Nov 6, 2025, 12:23 p.m.

Strive (ASST), an asset management company building a bitcoin BTC$102,012.68 treasury, is looking to raise $160 million after upsizing the initial public offering of 2 million of its Variable Rate Series A perpetual preferred stock (SATA) and pricing it at $80 per share.

The offering, scheduled to close on Nov. 10, was increased by 750,000 shares, the company said in a Wednesday release. Net proceeds will be used for general corporate purposes, including bitcoin and bitcoin-related investments, working capital and potential business acquisitions.

The Dallas-based company holds the 17th largest stash of bitcoin by a publicly traded corporation, according to Bitcointreasuries.net, with 5,958 BTC.

The stock will carry a 12% initial dividend rate on a $100 stated amount, payable monthly starting Dec. 15 when declared by Strive’s board. Under certain conditions, the rate can be adjusted within limits tied to the one-month term Secured Overnight Financing Rate.

Missed dividends will compound monthly at an increasing rate up to 20% per annum, and Strive will set aside a dividend reserve covering 12 months of payments.

Strive may redeem all or part of the SATA stock at $110 per share plus accrued dividends. It also has the right to redeem all shares if fewer than 25% remain outstanding or in certain tax events.

If a fundamental change occurs, holders may require Strive to repurchase their shares at $100 plus accrued dividends.

The company aims to manage the dividend rate to keep the SATA stock price between $95 and $105. The liquidation preference starts at $100 per share and adjusts daily based on trading activity.

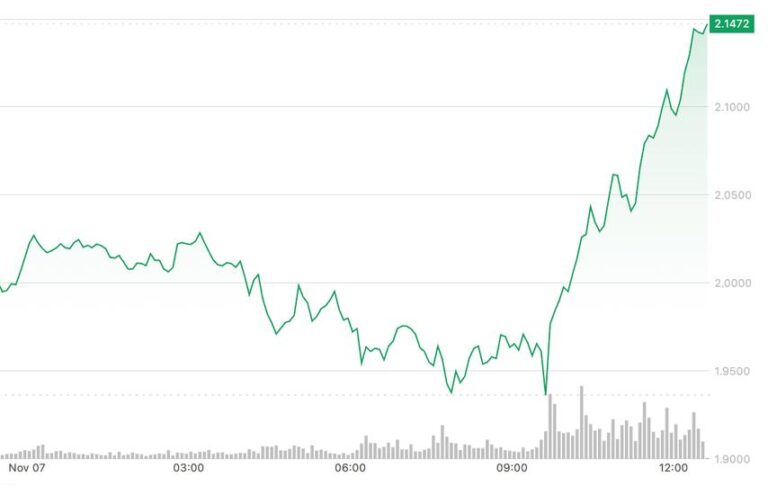

Strive shares rose 17% on Wednesday and were up another 8% in pre-market trading Thursday at $1.58.

More For You

Inside Zcash: Encrypted Money at Planetary Scale

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

Tenerife Council to Sell Bitcoin Bought in 2012 After Near 10,000% Price Rise

The proceeds from the sale will fund new research projects at ITER, including exploring fields like quantum technology.

What to know:

- The council of Tenerife bought 97 bitcoin in 2012 for €10,000 as part of a research project, and is now selling them for nearly €10 million, a massive increase in value.

- The cryptocurrency was purchased by ITER to study blockchain technology, not to make a profit, and selling the coins requires working with a regulated Spanish financial entity.

- The proceeds from the sale will fund new research projects at ITER, including exploring fields like quantum technology.